Hosts also don’t buy that Turo believes there’s a security risk. Turo was founded in 2009 and launched scheduled messages and photos in messages last year. “It took 10 years to get scheduled messages and photos within messages.”Īctually, it took 13 years. “I’d be surprised if a small fraction of are replaced in the next year,” wrote one Reddit user. What makes Turo hosts nervous is the timing - one month to try to replicate all that CarSync and Fleetwire do - and Turo’s track record when it comes to innovating on the platform. It’s clear that Turo is keen to bring more features in-house. Turo told TechCrunch the features would be rolling out in the next weeks and months, but didn’t say which features would be made available first. “These new features will help you run your business as efficiently as possible.” Co-hosting allows hosts to bring someone on to help them manage their listings. “Over the next few weeks, Turo will be releasing new features centered around enhancing vehicle pricing and management, toll automation and co-hosting,” said the email. Turo also lists security as one of the risk factors included in its S-1 filings. In the email sent to hosts, a Turo representative said the company had been made aware of “potential security risks” that can be created by third-party services. Security appears to be a top concern, according to its S-1 and communications with its hosts. So why, hosts are asking, would the company choose to remove the tools they use to grow and manage their fleets? In order to shift those percentages, Turo needs to provide more incentives to hosts and make the process of renting out their vehicles a lot easier.

TURO INVOICE PROFESSIONAL

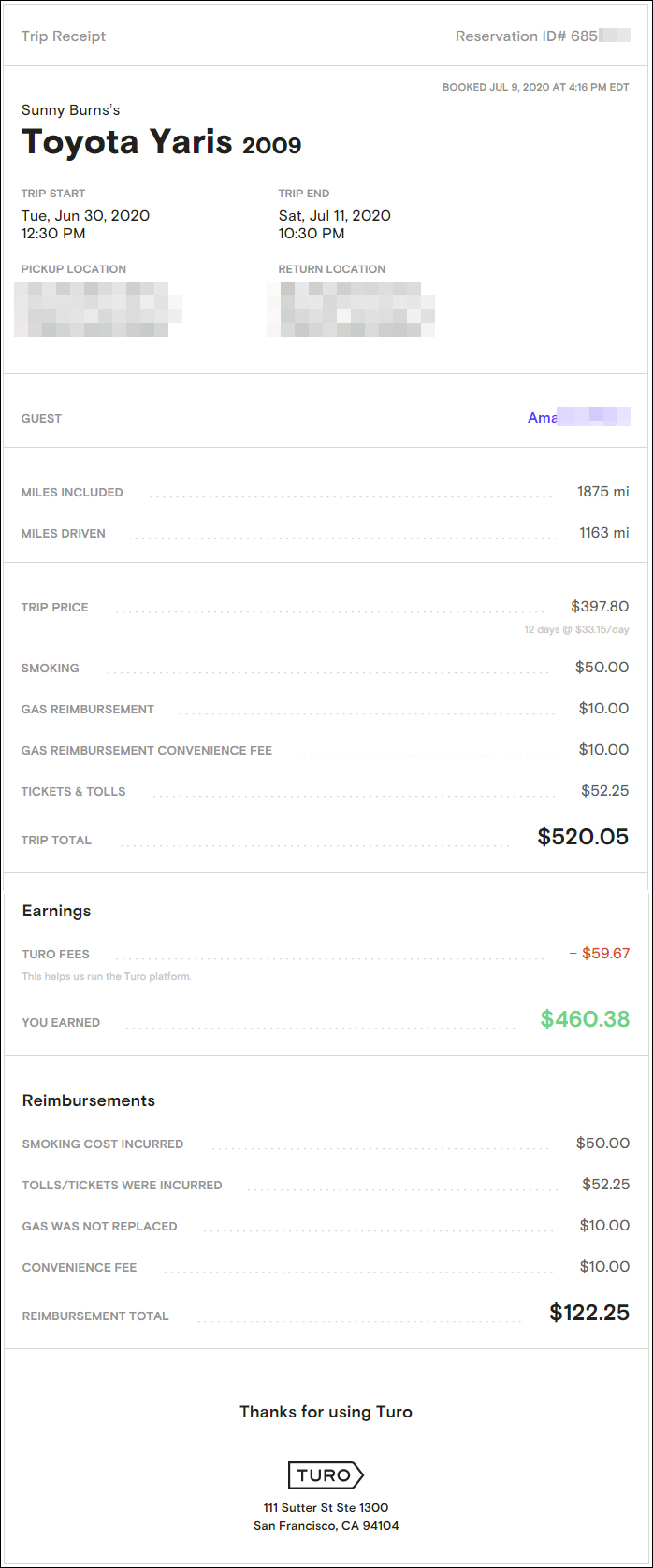

A key target is to increase the supply of vehicles available to guests by converting so-called “consumer hosts” who rent out one or two vehicles on the platform into “small business and professional hosts.” Small business hosts share three to nine cars, and professional hosts share 10 or more.Īs of December 31, about 85% of Turo’s 160,000 active hosts were consumer hosts. The results show a company that has emerged from the pandemic doldrums with rapid revenue growth and healthy levels of profitability.īut Turo still has work to do to shore up its finances. Turo recently updated its S-1 with the Securities and Exchange Commission with its 2022 financials. The blowback comes at a tricky time for Turo, which appears to be on the precipice of becoming a publicly traded company two years after filing confidentially for an IPO. Turo’s plans have sparked panic among many hosts, who have turned to social media platforms and even petitions on to argue the change threatens their businesses. They use CarSync and Fleetwire to manage their fleets and toll payments, as well as provide other useful services that have historically been absent from Turo’s app. While there is evidence that Turo intends to build many of these services within its own app, that hasn’t assuaged hosts who rely on these third-party services today.Ībout 24,000 of Turo’s hosts rent out more than three vehicles on the peer-to-peer car rental platform. Turo confirmed the move, which hosts say will cut them off from essential fleet management tools that allow them to share multiple cars on the platform. – As a result, many things become easier and transparent, such as invoice management, payment and cash flow monitoring, he lists.Turo, the peer-to-peer car rental company, plans to block access to third-party services like CarSync and Fleetwire starting April 30, according to an email that hosts received and TechCrunch viewed. Data and information related to assignments are transferred in real time between different systems and databases when it comes to transferring an invoice to collection, making a payment, status information or reporting. The utilization of data is key for success. Every collection process can be agreed on a customer-specific basis thanks to a flexible system and modern technology. Rytsölä emphasizes the opportunity for clients to make choices. Flexibility, modern technology and real-time data transfers We are able to offer all the most commonly used payment methods and channels as well as flexible payment plans for paying the unpaid invoice. Otherwise, the activities towards end customers for paying invoices must be on a completely different level. Methods of handling payments familiar from today’s banking world could also be used in the debt collection industry. – The industry would have tools and opportunity to act differently. We are looking for experts especially in receivables management and customer service.” TURO RYTSÖLÄ, HEAD OF SALES

I believe that we will hire 10–20 people in Finland by the end of this year. There is a lot of potential and opportunities. “Our goal is to be a major player in Finland.

0 kommentar(er)

0 kommentar(er)